Estate Planning Lawyer North Kingstown, RI

Serving Rhode Island, Massachusetts, And Connecticut

North Kingstown Estate Planning Attorney

If you need help planning an estate in North Kingstown, RI you’ll be glad to know about McCarthy Law, LLC. They are a well-respected estate planning firm. You’ll find all their contact information here.

Table Of Contents

- Digital Estate Planning Considerations

- Frequently Asked Questions About Estate Planning

- North Kingstown Estate Planning Infographic/a>

- North Kingstown Estate Planning Law Statistics

- Estate Planning Lawyer North Kingstown, RI

What Is Estate Planning?

If you need help planning an estate in North Kingstown, RI you’ll be glad to know about McCarthy Law, LLC. They are a well-respected estate planning firm. You’ll find all their contact information here.

Estate planning matters, for many people, are one of the most complex issues to take on. Planning for your wealth, future and the needs of your loved ones after you are gone is a delicate matter. Laws concerning estate planning are not easy to understand because they involve so many complex terms and it is not always clear how they apply to a situation. There are many ways you can make an estate plan. From living wills to trusts, there are many things you could decide to include in your plan. The good news is that a lawyer can make sense of your situation. If you need guidance in making or adjusting an estate plan, you can turn to a qualified lawyer so that they can evaluate your situation and choose between your many options.

Estate law is a special type of law designed to help you protect your wealth, even if it doesn’t seem like very much at the moment. Regardless of the size of your income or number of assets that you have, you can benefit from having an estate plan. It lets you conserve your assets and make sure, when you pass, that what you leave behind will be given or distributed exactly to the people and institutions you want to have them. That might include relatives, friends and organizations that do the kind of work you want to support. You can choose where your valuables go and how you can be sure your wishes will be honored. While many people think that it is not necessary to create an estate plan, it puts you more at a disadvantage without one. Having a plan established not only secure your wealth, but allows for a more efficient process to hand down your assets to your loved ones.

But good estate planning can do much more. If, for example, you have young children, an estate plan is where you might appoint their guardians in the event of your premature death. Some people even make arrangements for a beloved pet. Whatever your unique needs and values, an estate planning attorney can give you the direction you need to make the right choices. You do not have to go into the process blind. With an estate plan you can often reduce various taxes on what you leave behind. With so many ways to make an estate plan that serves you and your family, it can be hard to decide what to include in one. Allow a lawyer to advise you through every step and simplify the estate planning process.

Perhaps most importantly, when you leave an estate plan your family knows what you intended because it’s been spelled out in legal form. This often reduces family strife and arguments. In your estate plan you can actually plan and fund your funeral in advance if you are so inclined.

Laws governing estate plans vary from state to state which is why you want an estate attorney that lives in the same area as you do. A lawyer can provide you with more information about how these laws are interpreted and the ways in which they affect your goals.

Why All Adults Need an Estate Plan in Place

When teenagers reach the age of majority, their parents are no longer automatically empowered to make legal, medical, and financial decisions on their behalf. As a result, if you’re an adult and something happens to you, your parents won’t automatically be recognized as the individuals empowered to act on your behalf. Whether you want your parents acting on your behalf in the event of your incapacitation or death is your business. But the court won’t recognize your preferences unless you name a power of attorney, write a will, and take the other steps necessary to make your preferences known. In the event that you don’t take these steps, it is likely that your closest relatives (as defined by marriage or blood) will be granted such authority as dictated by state law.

All adults, younger and older, need an estate plan in place because no one is guaranteed a specific amount of time on Earth. In the event that something happens to you tomorrow, you’ll need to have legally-enforceable documentation in place which will ensure that your needs and preferences are honored.

Why DIYing Your Estate Plan Isn’t a Great Approach

Our North Kingstown estate planning team at McCarthy Law, LLC truly respect the goals of thrift and efficiency. Yet, we also understand how consequential the execution of an estate plan can be. Don’t be tempted to cut corners by crafting an estate plan yourself or by discovery calling potentially inaccurate online resources. Allow us to help you protect your wishes in the event of your death or incapacitation. The stakes are simply too high to leave room for mistakes.

Philosophy

Samantha McCarthy Jarvis, Esq. founded the firm carrying her name, after she came to know and love Rhode Island. She developed a passion for both estate planning and elder law after watching her grandfather, who had multiple sclerosis. She began to work with the disabled and saw how often poor or no estate planning left families devastated. She founded her law firm determined to make a positive difference for her clients. That vision guides her every decision. McCarthy’s is also licensed in the state of Massachusetts.

Digital Estate Planning Considerations

When you meet with an estate planning attorneyNorth Kingstown, RI residents trust, they’ll fill you in on everything you need to know to meet your estate planning needs and goals. Additionally, they’ll provide personalized legal guidance concerning some aspects of the estate planning process that you may not yet have considered. For example, the dedicated team at McCarthy Law, LLC has witnessed a significant evolution in the estate planning process over the past decade or so. The issue of digital estate planning has become relevant to virtually every estate planning effort that takes place in Rhode Island.

Digital estate planning accounts for how your online assets and presence will be handled in the event of your death or incapacitation. Take a few moments to mentally list the number of sites that you access on a regular basis that require a login. If you’re like most Americans, you have multiple online subscription accounts, you log into social media regularly, you do much of your banking online, and you have intellectual property stored in the Cloud. Have you given any thought to who you’d like to access these accounts and how you’d like them to be managed after your death? Is there any information that you don’t want accessed by your loved ones?

When our North Kingstown estate planning lawyer team works with you to build an estate plan that fits your needs, we’ll take the issue of digital estate planning into account. We’ll also help you make sure that any accounts that your loved ones will need to access after your death remain appropriately accessible then and not before.

Frequently Asked Questions About Estate Planning

If you are concerned with planning for your state, it is generally a good idea to discovery call with an estate planning lawyer North Kingstown, RI residents trust. Before your discovery call, here are five frequently asked questions already answered for you about estate planning.

- What does estate planning entail? The details of estate planning vary depending on your assets. For many people, estate planning includes at the very least a will or trust to dictate how you want your assets used or divided when you pass away. Often estate planning also includes a durable power of attorney or medical power of attorney to protect your wishes should you become unable to make medical decisions for yourself. Estate planning can also include living wills or advance directives. Estate law is complex and there are many facets, so discussing your situation with a North Kingstown estate planning lawyer can help make sure you think through every aspect of your estate.

- If I already have a will, does that mean I planned for my estate? While a will is a very important part of planning for your estate, it does not necessarily mean you have planned for your full estate. Generally estate planning is more comprehensive than just a will to include issues broader than who will get your assets in the event of your death. Often estate planning goes further to think about who you would want making decisions for you if you are unable.

- What legal documents should I have to take care of my estate? Generally it is recommended that people have at least a will, a durable power of attorney for healthcare and a financial power of attorney. In many cases, these legal documents will provide a good amount of coverage, however, each situation is unique. The best way to be sure your estate is covered taking into account what is important to you and your unique assets and situation, is to discovery call with a North Kingstown estate planning lawyer.

- How do I know if I need a will or a trust? Deciding between a will and a trust depends on many factors and personal preferences. While wills are distributed after your death, trusts are often set up while you are still alive. In a trust, your assets are managed by trustees who manage the transferred assets until your death and after. Trusts offer the opportunity to reduce real estate taxes, whereas wills can be more effective to offer financial security to loved ones. When trying to decide between the two, it can help to take inventory of your property, investments, pensions, and other assets to see which option provides the benefits most important to you.

- What happens if I die without a will? The term for someone who dies without a will is “intestate” which means that the government through the court system will distribute your assets. The court will have the power to decide which of your beneficiaries get what property, amount of money or other assets. If you have children, the court will even get to decide who is best suited to raise them in your absence. While courts attempt to do the best job they can, the only way to guarantee your assets are divided the way you intended is to do the preparation ahead of time and plan for your estate.

Do not wait any longer! Schedule your free discovery call today with McCarthy Law, LLC.

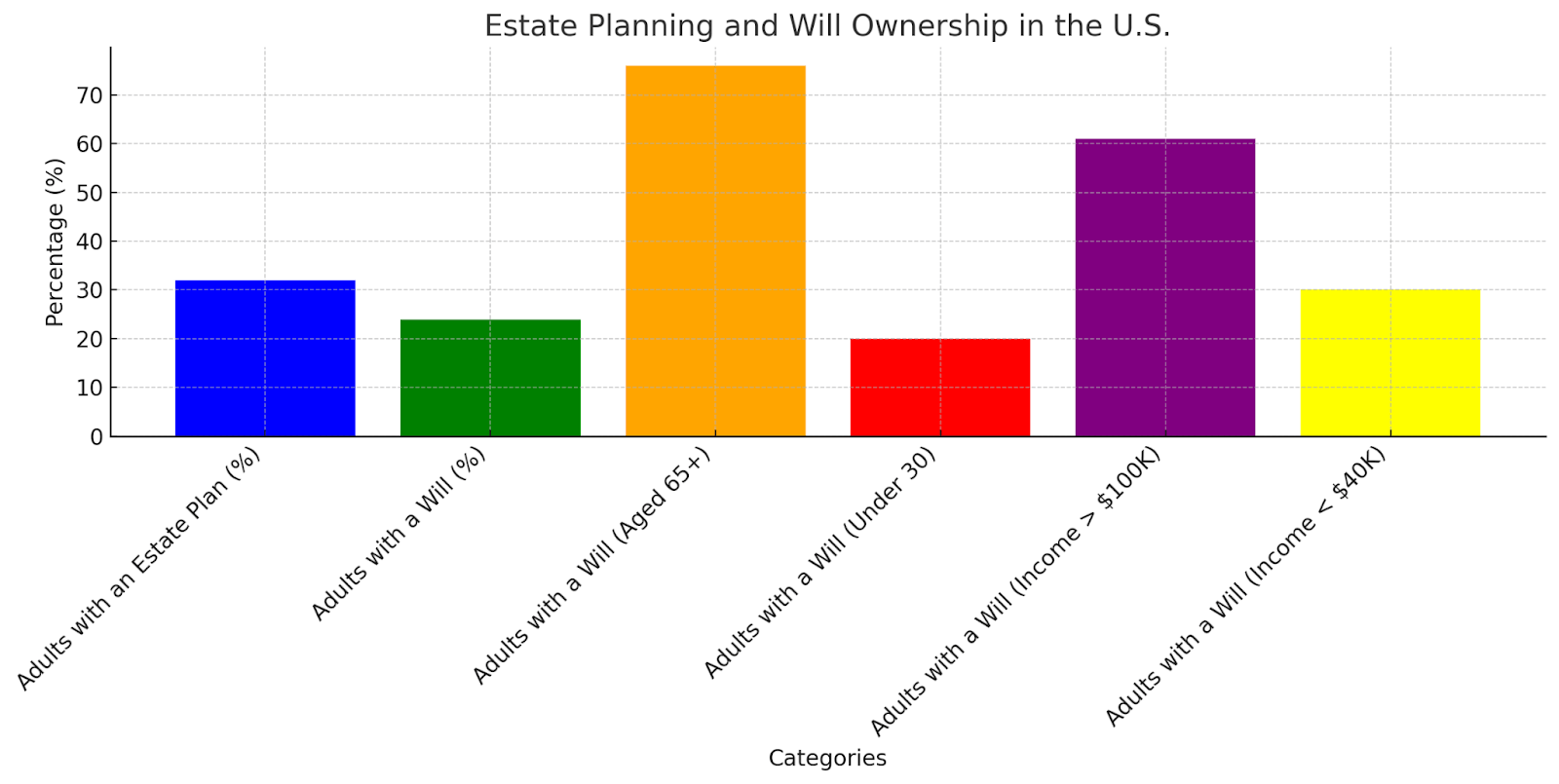

North Kingstown Estate Planning Infographic

North Kingstown Estate Planning Statistics

Approximately 32% of American adults have an estate plan, which typically includes a will, trust, and powers of attorney for healthcare and finances. This statistic underscores a substantial gap in preparedness, leaving many individuals’ assets and healthcare decisions vulnerable to state laws and court interventions.

The likelihood of having a will increases with age and income. Among individuals aged 65 and older, about 76% have a will, whereas only 20% of adults under 30 possess one. Income also plays a role; 61% of adults with annual incomes of $100,000 or more have a will, compared to 30% of those earning under $40,000.

Several factors contribute to the absence of estate planning among Americans. Procrastination is a primary reason, with 43% of individuals reporting they simply haven’t gotten around to it. Additionally, 56% feel they don’t have enough assets to justify creating a plan. Other reasons include the perceived complexity and cost of estate planning documents.

North Kingstown Estate Planning Law Statistics

According to a survey conducted by Caring.com, more than 60 percent of Americans do not have wills drafted or any other estate planning tools in place. That comes out to two out of every three Americans.

Estate Planning Lawyer North Kingstown, RI

If you or a loved one is ready to plan for the future and create an estate plan, it would be advantageous to contact an estate planning lawyer North Kingstown, RI clients trust for a discovery call today.

While there are many reasons why it is wise to hire an estate planning lawyer the following are a few of the top reasons:

- An estate planning lawyer provides you with guidance and experience as you prepare your estate plan. Your attorney will carefully go through various aspects of your estate, and work with you to formulate a plan that will distribute your wealth and assets to your beneficiaries.

- An estate planning lawyer ensures that your loved ones are taken care of. By hiring an attorney from McCarthy Law, LLC you are providing yourself with peace of mind, knowing that your family is going to be looked after. Creating an estate plan allows you to purposefully distribute your assets to your loved ones, diminishing confusion or family tension. When there is no estate plan, the family often has to fight over assets, often going to court and creating a lot of hostility among the family members. North Kingstown estate planning lawyer assists in the distribution and communication of the assets to the beneficiaries.

- An estate planning lawyer can ensure all proper documentation is present within the estate plan. There are many aspects that encompass an estate plan including medical directives, a living will, a plan for children, and important bank and retirement information. Although collecting and creating these documents may seem daunting, your attorney will help you along the way.

- An estate planning lawyer will provide you assistance as you plan for your future, and decide what type of medical care you wish to receive. Medical directives are particularly important because they protect the wishes of the estate owner, and do not leave the problematic end-of-life medical decisions to the family’s discernment. Having a medical intervention plan or stating a DNR are important aspects of a person’s medical directive and should be carried out within the estate plan. Without a plan, family members will be forced to make those decisions on behalf of the estate owner, which could lead to discord and tension among the family members.

- An estate planning lawyer works within state law to protect your estate plan from tax and state complications. Each state varies in its particular guidelines for estate planning and tax implications. Rather than trying to research and find this information by yourself, hire an estate planning lawyer to help do this for you. They are experienced within their state law and taxes and will ensure your estate plan is not contested under those guidelines.

- An estate planning lawyer will help you understand what your options are as you plan for your future and your children’s future. If you have young children, it would be in your best interest to create an estate plan, and especially a plan for your children as soon as possible. If you were to pass unexpectedly, your young children will need a plan for their protection, caretaking, and financial support. An attorney specializing in estate planning will aid in helping you create this plan. Contact a North Kingstown estate planning lawyer today and start planning for your future!

Free, Confidential Discovery Call

The firm of McCarthy Law offers every potential client a confidential discovery call at absolutely no cost to you. This meeting is where you can get all your questions about your own estate needs or your concern for the needs of someone in your family.

During the meeting you’ll be asked:

- To describe your understanding of your situation.

- What kinds of results you’re actually looking for

- You’ll also be asked about your own questions and will be given answers that will help you know what decisions you want and need to make

- The costs involved will be explained to you and a discussion of how you might meet these costs will be explored.

You should not wait to find out what your estate planning options are and ask how you can obtain personalized help. If you need help adjusting an estate plan or you have no idea what to do to begin making one, it is strongly advised that you contact a lawyer so that they can assess your goals and how you can best accomplish them. You should consider hiring an attorney who has experience helping clients fulfill their estate planning needs.

Estate Planning Glossary

When working with a North Kingstown, RI estate planning lawyer, it’s important to become familiar with key legal terms used in the estate planning process. These terms may appear in your documents or come up during discussions with your attorney. The definitions below provide clear explanations of several essential estate planning concepts that may be relevant to your situation. Understanding these terms can help you participate more fully in the planning process and make informed choices.

Durable Power Of Attorney

A durable power of attorney is a legal document that allows one person (the principal) to designate another individual (the agent) to handle their financial or legal matters. Unlike a standard power of attorney, a durable power of attorney remains effective if the principal becomes incapacitated. This makes it a foundational part of many estate plans, as it ensures that someone trustworthy can act on your behalf in managing property, paying bills, handling tax matters, or dealing with banks and other institutions, even if you lose the ability to do so yourself. This authority ends upon the death of the principal unless specifically revoked earlier.

Advance Directive

An advance directive is a legal document that outlines your preferences for medical treatment in case you’re unable to communicate your wishes. This document may include a living will and a designation of a health care proxy, who is empowered to make decisions on your behalf. In Rhode Island, having an advance directive in place can be especially important to avoid delays or confusion during medical emergencies. It can cover a range of care decisions, such as life-sustaining treatment, DNR orders, or pain management. Without this document, decisions may be made by people who are not aware of your personal values or goals.

Revocable Living Trust

A revocable living trust is an estate planning tool used to hold ownership of your assets during your lifetime and distribute them after death according to your instructions. The person who creates the trust (the grantor) often also serves as the initial trustee and beneficiary. Because the trust is revocable, the grantor can make changes or terminate it entirely during their lifetime. One primary advantage is that it allows the estate to avoid probate, which can save time and keep financial matters private. After the grantor’s death, a successor trustee takes over to manage and distribute the trust assets as directed. This is commonly used for property, bank accounts, and other valuable assets.

Intestate Succession

Intestate succession refers to the legal process by which a person’s property is distributed when they die without a valid will. In such cases, the state of Rhode Island has specific laws determining who inherits the estate. Generally, close family members—spouses, children, parents—are prioritized. However, these laws may not reflect the wishes of the deceased. For example, unmarried partners or friends would likely receive nothing under intestate succession rules. Creating a will or trust can help avoid this default system and allow individuals to make personalized decisions about the distribution of their estate.

Digital Asset Management

Digital asset management is an increasingly important part of estate planning. This refers to how your digital presence—such as online banking, email accounts, social media profiles, and cloud-stored documents—will be handled if you become incapacitated or pass away. Digital assets can also include financial accounts, domain names, and cryptocurrency. Proper digital asset planning allows you to name someone who will be authorized to access these accounts and follow your instructions regarding their use or closure. Without this preparation, family members may face barriers when trying to manage or shut down online services, and some assets may be lost entirely.

Working with an experienced legal team allows you to create a comprehensive plan that reflects your priorities and protects your loved ones. We help clients across North Kingstown evaluate all parts of their estate—from property and finances to medical preferences and digital accounts. If you’re looking to take that step, McCarthy Law, LLC is here to guide you with experience and clarity.

Ready to begin your estate plan or update an existing one? Contact us today to schedule a confidential consultation. We’ll walk through your options and help you move forward with confidence.

Receive Estate Planning Guidance Now

Many people who are considering creating an estate plan do not take advantage of legal help that is available to them. This is a big mistake because an estate plan is one of the most important documents you can work on for yourself and your family. Getting started on it early with a qualified lawyer will allow you to prepare it right. You do not want to see if you can get legal help when it is too late to do so. Act sooner than later and see how you can get into contact with a trusted and highly qualified lawyer who can help you meet your estate planning goals and address all your concerns. You’ll come away with a much better understanding of if, and how, an estate plan might benefit you and your family. You’ll also discover what sort of action you can take now and be much better prepared for the future. Contact McCarthy Law, LLC for Estate Planning in North Kingstown, RI.

You’ll come away with a much better understanding of if, and how, an estate plan might benefit you and your family. You’ll also discover what sort of action you can take now and be much better prepared for the future. Contact McCarthy Law, LLC for Estate Planning in North Kingstown, RI.

Get Started Now

Share a few details about your situation, and someone from our firm will be in touch soon to set up an appointment.