Your Warwick Estate Planning Attorneys

If you are looking for help with your estate plan, it is best to speak with an estate planning lawyer in Warwick, RI. When you are making choices about your estate plan, one of the most important decisions you can make is who you will choose to name as the executor. As a lawyer from McCarthy Law, LLC understands, the person you name as the executor of your estate will be ensuring that your final wishes go according to plan and that any remaining debts are paid and your assets are fairly distributed. Each state will have its own specific rules regarding who may be the appointed executor of an estate.

Table Of Contents

- What Are Rhode Island's Rules Regarding Executorship Infographic

- Learning About The Role Of Executor

- What Is Probate?

- What Can An Estate Planning Lawyer Do For Me?

- Warwick Estate Planning Law Statistics

- Do I Really Need An Estate Planning Lawyer?

- McCarthy Law, LLC, Warwick Estate Planning Lawyer

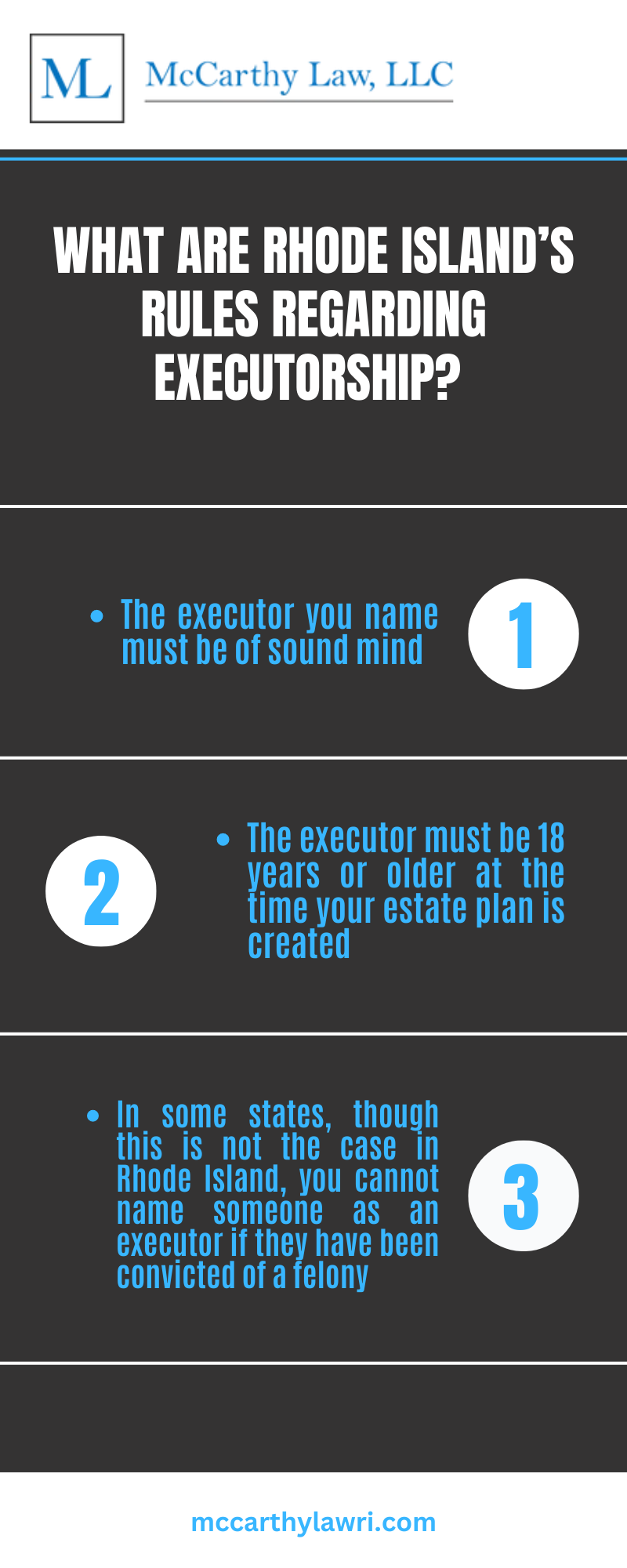

What are Rhode Island's rules regarding executorship?

You may be wondering if you can name anyone as an executor, whether it is your mom or your best friend. The truth is, there are a few laws regarding who you can give this title to.

- The executor you name must be of sound mind

- The executor must be 18 years or older at the time your estate plan is created

- In some states, though this is not the case in Rhode Island, you cannot name someone as an executor if they have been convicted of a felony

What Are Rhode Island's Rules Regarding Executorship Infographic

Learning About the Role of Executor

Your Warwick, Rhode Island estate planning lawyer understands that one of the most important roles you will name in your estate plan is the role of executor. The probate court involved in your estate can determine what a fair compensation amount is for the person you appoint as executor.

What is an Executor?

After your death, your will may name an executor. The executor is a trusted individual in charge of distributing the contents of the will and managing the estate. However, not all beneficiaries might agree on your choice of executor. It's not uncommon for estranged family members to appear out of nowhere to claim a piece of your estate, so contact an estate planning attorney in Warwick, RI to see how you can keep the process as streamlined as possible.

What happens if the person I appoint as executor passes away?

A trusted Warwick, Rhode Island estate planning lawyer understands that there are times when a named executor passes away before getting to fulfill their executor duties. When this is the case, we always encourage clients to name an alternate executor. If you do not name an alternate executor or your alternate executor also passes away, a probate court judge can appoint someone as your estate's executor.

I have someone in mind for the role of executor but they do not live here. Can they still be my estate's executors?

Although it can make things more difficult, you can still legally appoint an out-of-state executor. That said, Rhode Island requires an out-of-state executor to name someone as a resident agent who will be able to accept and take care of legal documents on behalf of your named executor. Remember, when your executor needs to make decisions regarding your estate plan, there will be many choices to make on a daily or weekly basis that must be done locally.

If you are interested in learning more about estate plans or who you should name as your executor, don't hesitate any longer to speak with a team member from McCarthy Law, LLC. Our estate planning lawyer in Warwick, Rhode Island can help you every step of the way.

What is a Will?

A will is one of the most important documents you can leave behind for your family and friends. Your will is a list of your assets (possessions such as real estate, collections, and investments) and to whom you wish to give these assets after your death. The contents of a will are meant to be divided across your beneficiaries, but it can be challenging when it comes to execution.

What is Probate?

After your executor is named, it's up to them to make sure the instructions in your will are carried out. This is a lengthy process known as probate. It involves authenticating the will and informing all beneficiaries (and creditors, if you died with outstanding debts) about your passing. Additionally, your assets will have to be assigned a value, and in certain cases your estate will have to pay the necessary estate taxes.

Probate is a long and frustrating process, and there's plenty of opportunity for your beneficiaries to disagree and fight over what you've left behind for them. It's important to make sure they are able to easily process your last wishes without any unnecessary drama. Fortunately, you can look into creating a living trust instead.

Will everything go through the probate process?

Not necessarily. In instances where you share a property with someone else, the property will pass on to the surviving owner after you die. In this circumstance, the property will not go through probate. Similarly, if you have named people as beneficiaries to your life insurance policies or retirement accounts, those assets can be transferred immediately to the named beneficiaries without needing to go through probate.

Is the probate process quick?

Unfortunately, there is no set time that it will take for an estate to go through probate. The minimum time is six months, which gives any creditors the opportunity to come forward and submit their claims. During this time, your executor can use funds from your estate or from selling your assets to pay off the rest of your debt. Further, any arguments that arise during the probate process over who will get certain assets can lead to the probate process taking much longer. If you foresee family or friends coming forward to contest your estate, it is best to create a solid estate plan with the help of your lawyer.

Why should I avoid probate?

There are several reasons to avoid the probate process. It can be an expensive and time-consuming process so many people do what they can to avoid going through it. If you do not go through probate, you don't need to have your estate evaluated by the court after you pass away. It is also easier for your family members to access the assets that you passed down to them when you do not have to go through the probate process. Everything goes through probate however. If you are not sure which of your assets will be subjected to the probate process, a lawyer can assist you and explain to you how you can best navigate it.

Getting Legal Help Today

You may be tempted to work through a cheap, inexpensive, DIY estate plan that you find online. However, these are often not comprehensive or state-specific. It is always best to create your estate plan with the help of a lawyer. Are you looking for the right legal match during the estate planning process? Contact McCarthy Law, LLC to speak with our estate planning lawyer in Warwick, Rhode Island now.

What is a Living Trust?

A living trust (also known as a trust) is like a will, but it requires more input and management during your lifetime. While a will is relatively straightforward to create, a living trust requires a complicated (and usually pricey) setup. Like wills, your living trust will outline your beneficiaries and your assets. Unlike wills, however, a living trust means no probate. The terms of a living trust are uncontestable, meaning whatever you've dictated in the trust is what should happen.

How Can a Lawyer Help Me?

It's not always pleasant planning for what happens after you die. Not many people like to think about it. Despite this fear and uncertainty, it's important to put a workable plan in place for the people you care about and love.

When you contact an estate planning lawyer, you get a trusted legal advisor who can walk you through the potential pitfalls that your family might face after your death. You also minimize the chances of anything going wrong when it's time to divide your estate across all your beneficiaries. Don't hesitate to plan your future: Reach out to an estate planning lawyer in Warwick, RI today, and see how McCarthy Law, LLC can help.

What Can An Estate Planning Lawyer Do For Me?

An experienced Warwick, RI estate planning lawyer can offer you a variety of different legal services to secure your assets and protect your estate. If you have loved ones that you want to pass on your assets to you can trust an estate planning lawyer to assist you with the process. During a consultation, a lawyer can assess your finances and discuss with you in depth the ways that you want to protect your assets and if you want to pass them down to any loved ones or organizations. Handling the various tasks of estate planning can be difficult to do by yourself, however with a trusted lawyer they can give you the personalized legal support that you need to form an estate plan that you are satisfied with.

When should I get an estate planning lawyer?

It is important to speak with a qualified and experienced estate planning lawyer as soon as possible so that you can form an estate plan that reflects your needs and preferences for your finances. Many people make the mistake of working on their plan with little knowledge about how to properly develop one. You can rely on an estate planning lawyer if you are unsure about how to begin preparing an estate plan or if you're confused about any part of the process. There are many estate planning laws and it can be hard to understand them. As a trusted Warwick estate planning lawyer can tell you more about, waiting too long to work on an estate plan can make it much more difficult to plan one that suits your needs.

Do I need an attorney if I have a small estate or few assets?

Many people think estate planning is just for the wealthy or those who have many assets. However, even if you have few assets or have a moderate income, estate planning can be beneficial for you. Even if you have a smaller estate, an estate plan can still protect any amount of assets and possessions that you have. You can accomplish many things through estate planning, especially if you have assets that you want to pass to specific family members or a charity organization. It is important to be thoughtful about how you want to protect your assets because there may be other people who want to try to see you to seize them.

Do I need to protect my estate if I don't have children?

Estate planning may be worth it for you even if you do not have children or heirs. Estate planning allows you to secure your assets and manage them in a secure manner. If you want to keep full control over how you want your estate to be handled after your death, you should consider making an estate plan. Otherwise, the court will get to determine how they will distribute your assets. You can count on a lawyer to give you personalized legal advice and work on the difficult tasks for you like filling out paperwork, reviewing them for errors, and evaluating your assets. Without a lawyer's support, you may make mistakes that can harm your case or worsen your situation. Speak to a Warwick estate planning lawyer to discuss strategies that can help you develop a strong estate plan.

Warwick Estate Planning Law Statistics

According to a survey conducted by Caring.com, more than 60 percent of Americans do not have wills drafted or any other estate planning tools in place. That comes out to two out of every three Americans.

Do I Really Need an Estate Planning Lawyer?

Estate Planning is not something most people think of very often; in fact, it is probably something many people would prefer not to think of at all. You may wonder if the services of an estate planning lawyer in Warwick, RI are appropriate for you. Reservations and concerns about whether you should hire an estate planning attorney like McCarthy Law, LLC are actually quite easy to answer.

I don't have a huge fortune to distribute.

Contrary to what many believe, estate planning is not for the super-wealthy alone. Many people of more moderate incomes may also need to plan for their estate. Most people have at least a few significant assets, like real estate or retirement accounts, that they will want disposed of properly after their death. Estate planning can also give you peace of mind about how your children or other dependents would be cared for if something unforeseen happens to you.

Estate planning is really just about making sure the things and people who matter are provided for and that your wishes are spoken for when you can no longer speak for yourself.

I have very few heirs.

If you have a small number of heirs, it is tempting to believe that they will be able to just "sort things out for themselves" when it comes to disposing of your property after your death. Assumptions like this are a recipe for conflict and heartache. Remember, planning for your estate is about streamlining the probate process for those you leave behind, no matter how many or few there are. Thoughtful estate planning leaves them with gratitude instead of trouble.

I have a financial advisor to help with these things.

Accountants and financial advisors may provide useful information when it comes time to plan your estate, but they are not legal experts. Don't forget that estate planning is about not just finances, but the law as well. Even a highly skilled financial advisor is not empowered or trained to do all the things an estate planning lawyer in Warwick, RI will do for you and your family.

I don't know which lawyer or advisor to trust.

A dedicated focus on estate and probate planning is the first thing you should seek out when choosing an estate planning lawyer in Warwick, RI. An attorney's membership in relevant boards and professional organizations can also give you the reassurance that you are working with a professional who has high standards and integrity. Finally, testimonials from prior clients can tell you a lot about a firm's reputation, and a trustworthy estate attorney like McCarthy Law, LLC will proudly publish their client reviews.

When you are considering creating or revising an estate plan, an estate planning attorney in Warwick, RI from McCarthy Law, LLC knows that one of your biggest questions may be about probate. What exactly is probate and how do your assets go through the probate process? Typically, if you create a revocable living trust, your assets will not need to go through the probate process because they will be transferred directly to your named trustee. However, when you create a will, you may be more interested in the finer details of probate.

McCarthy Law, LLC, Warwick Estate Planning Lawyer

19 First Avenue, East Greenwich, RI 02818